How Biometric Technology is Enhancing Security in Kenyan Banks in 2025

Introduction

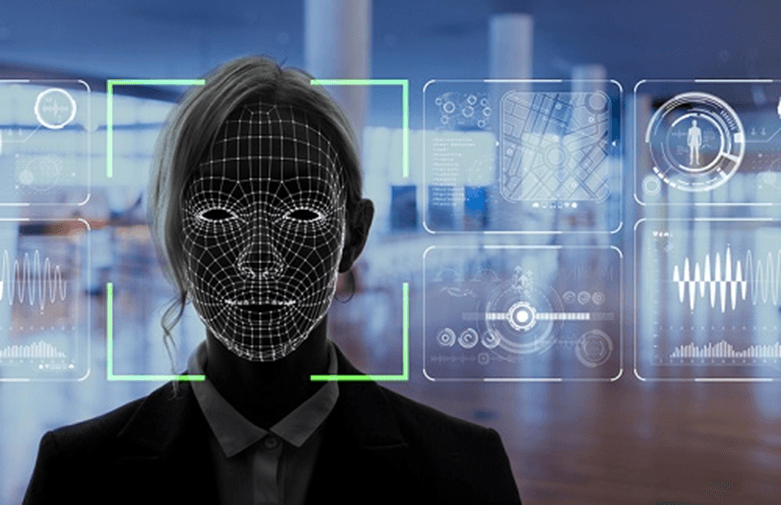

Biometric technology is transforming the banking sector worldwide, and Kenya is no exception. As cyber threats and identity theft grow, banks are adopting biometrics to enhance security, improve customer experience, and streamline operations. From fingerprint scanners to facial recognition, these technologies are becoming critical tools in the fight against financial fraud.

In this blog, we will examine how biometric technology is revolutionizing security in Kenyan banks, the benefits it offers, and the challenges it faces in 2025.

Biometric Technology in Kenyan Banking

Kenyan banks are integrating biometric solutions across various platforms:

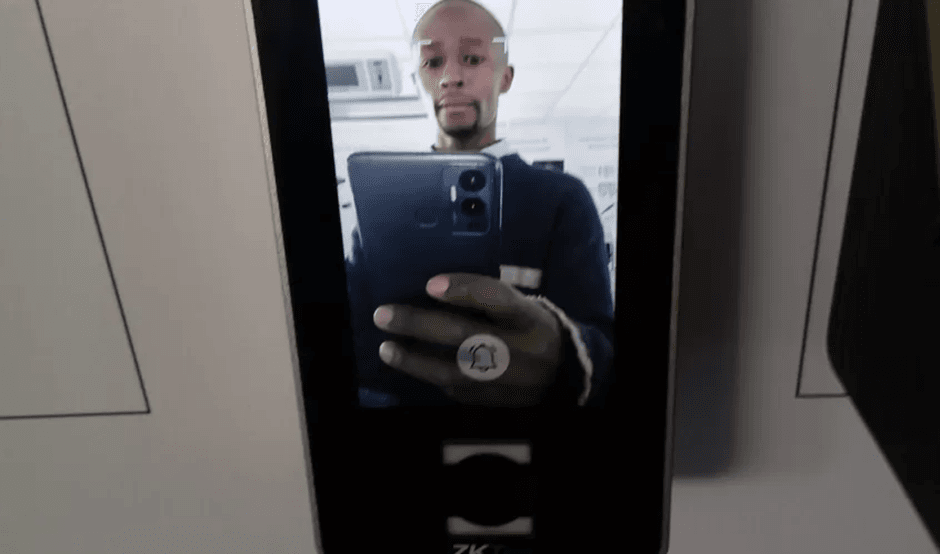

- Account Authentication

Banks are using fingerprint and facial recognition for secure customer authentication at ATMs and branches. - Mobile Banking Integration

Biometrics such as voice and facial recognition are enhancing security for mobile banking applications. - Know Your Customer (KYC) Compliance

Biometric verification simplifies KYC processes, ensuring regulatory compliance and reducing onboarding time for new customers.

Benefits of Biometric Technology in Banking

- Enhanced Security

Biometrics provide a unique and nearly foolproof method of authentication, reducing the risks of identity theft and fraud. - Improved Customer Experience

Faster and hassle-free authentication processes lead to better customer satisfaction. For example, customers can access their accounts with a fingerprint scan rather than remembering passwords. - Cost Reduction

By preventing fraud and streamlining processes, biometrics can help banks reduce operational costs in the long run.

Challenges in Biometric Adoption

- High Implementation Costs

Deploying biometric systems requires significant investment in hardware and software, which can be a barrier for smaller banks. - Privacy Concerns

Customers may be wary of sharing their biometric data due to concerns about data misuse or breaches. - Infrastructure Gaps

Limited access to reliable power and internet in rural areas hinders the adoption of advanced biometric systems.

The Future of Biometrics in Kenyan Banks by 2025

- Multimodal Biometrics

Banks will increasingly adopt multimodal systems combining fingerprints, facial recognition, and voice authentication for enhanced security. - Integration with AI

Artificial intelligence will enhance biometric systems, enabling real-time fraud detection and predictive analytics. - Nationwide Biometric Databases

Collaborations between banks and national initiatives like Huduma Namba will streamline identity verification, reducing redundancy and enhancing efficiency.

Conclusion

Biometric technology is reshaping the Kenyan banking landscape, offering unparalleled security and convenience for both customers and institutions. Despite challenges like high costs and privacy concerns, the potential benefits far outweigh the drawbacks.

By 2025, biometric systems will be indispensable for Kenyan banks, ensuring secure transactions, enhancing customer trust, and positioning the country as a leader in financial innovation in Africa.

References