Kenya’s Fintech Boom: How Mobile Payments Are Reshaping Financial Services

Introduction

Kenya has become a global leader in financial technology, driven by the widespread adoption of mobile payment systems like M-Pesa. These innovations have not only transformed how people transact but have also significantly boosted financial inclusion and economic development.

This blog examines the key drivers of Kenya’s fintech boom, the impact of mobile payments on financial services, and the challenges and opportunities that lie ahead.

Kenya’s Fintech Landscape

1. The Rise of Mobile Payments

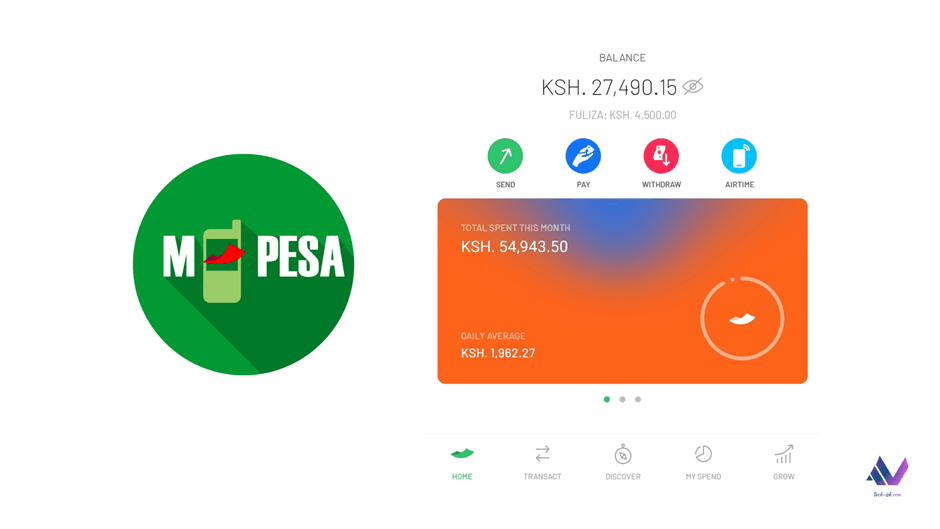

Kenya pioneered mobile payment systems with the launch of M-Pesa in 2007. Today, it processes billions of transactions annually and serves as a model for fintech innovation worldwide.

2. Growth of Digital Wallets and Payment Platforms

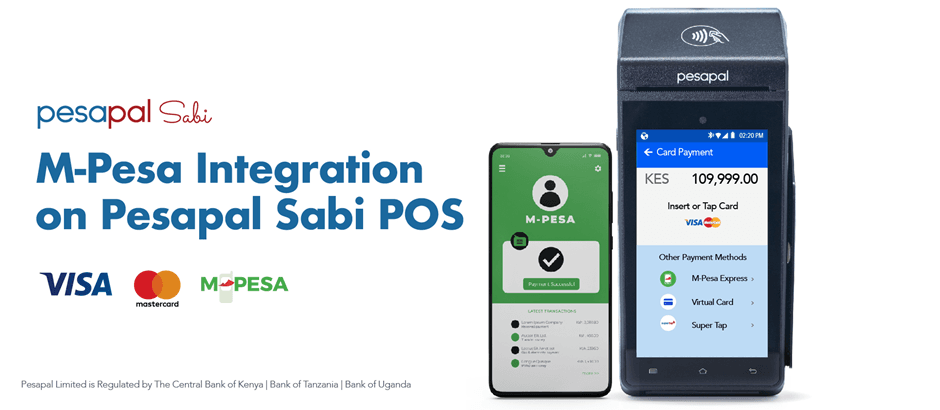

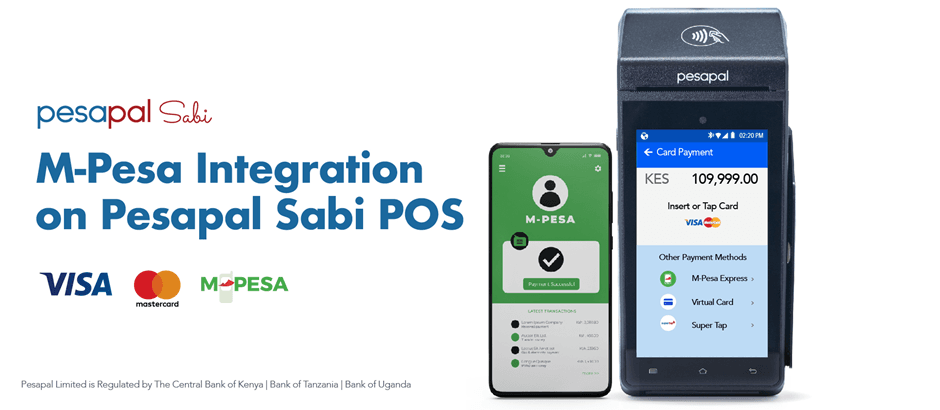

Other platforms like Airtel Money, T-Kash, and Pesapal have further diversified Kenya’s mobile payments ecosystem, promoting competition and innovation.

How Mobile Payments Are Reshaping Financial Services

1. Financial Inclusion

- Mobile payments have brought banking services to millions of unbanked and underbanked individuals, especially in rural areas.

- Women and small-scale traders have gained access to microloans and savings accounts.

2. Ease of Transactions

- Mobile payments simplify day-to-day transactions, from paying bills to purchasing goods and services.

- Peer-to-peer transfers are instant and cost-effective, even for users without traditional bank accounts.

3. Economic Growth

- Mobile payments have fueled the growth of small and medium enterprises (SMEs) by providing quick access to capital and secure payment methods.

- Increased economic activity has boosted tax revenues and GDP growth.

Key Drivers of Kenya’s Fintech Boom

- High Mobile Penetration

With over 60 million mobile connections, Kenya has a solid foundation for mobile-based financial services. - Innovative Regulatory Framework

The Central Bank of Kenya (CBK) has fostered fintech growth through progressive policies and oversight. - Partnerships and Ecosystem Collaboration

Telecommunication companies, banks, and fintech startups collaborate to enhance service delivery and reach.

Challenges in Kenya’s Fintech Ecosystem

- Data Security and Privacy

The rapid growth of mobile payments has raised concerns about data protection and cybersecurity. - Digital Literacy

Many rural users still lack the knowledge to fully utilize digital financial services. - Regulatory Hurdles

Balancing innovation and regulation remains a challenge, especially with emerging technologies like cryptocurrency.

Opportunities for Growth

- Expansion into Regional Markets

Kenya can export its fintech expertise to neighboring countries, creating a unified East African digital payment network. - Integration of Emerging Technologies

Artificial intelligence, blockchain, and big data can further enhance the efficiency and security of mobile payment systems. - Public-Private Partnerships

Collaboration between the government and private sector can drive infrastructure development and digital literacy campaigns.

Conclusion

Kenya’s fintech boom, fueled by mobile payments, has redefined financial services, providing unparalleled convenience, access, and economic opportunities. However, sustained growth requires addressing challenges such as data security, digital literacy, and regulatory consistency.

By leveraging its innovative spirit and expanding partnerships, Kenya can continue to lead the way in fintech, shaping the future of financial services across Africa and beyond.